Investor Bulletin: Understanding Order Types

July 12, 2017

The SEC’s Office of Investor Education and Advocacy is issuing this Investor Bulletin to help educate investors about the different types of orders they can use to buy and sell stocks through a brokerage firm.

The following general descriptions represent some of the common order types and trading instructions that investors may use to buy and sell stocks. Please note, order types and trading instructions available to you may differ between brokerage firms. Some brokerage firms may not offer some of the order types and trading instructions described below. Also, some brokerage firms may offer additional order types and trading instructions not described below. You should contact your brokerage firm to determine which types of orders and trading instructions it has available for buying and selling stocks as well the firm’s specific policies regarding the use of these orders and trading instructions.

MARKET, LIMIT and STOP ORDERS

Market Order

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed. It is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. In fast-moving markets, the price at which a market order will execute often deviates from the last-traded price or “real time” quote.

Example: An investor places a market order to buy 1000 shares of XYZ stock when the best offer price is $3.00 per share. If other orders are executed first, the investor’s market order may be executed at a higher price.

In addition, a fast-moving market may cause parts of a large market order to execute at different prices.

Example: An investor places a market order to buy 1000 shares of XYZ stock at $3.00 per share. In a fast-moving market the order could have 500 shares execute at $3.00 per share and the other 500 shares execute at a higher price.

Limit Order

A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

Example: An investor wants to purchase shares of ABC stock for no more than $10. The investor could submit a limit order for this amount and this order will only execute if the price of ABC stock is $10 or lower.

A limit order is not guaranteed to execute. A limit order can only be filled if the stock’s market price reaches the limit price. While limit orders do not guarantee execution, they do help ensure that an investor does not pay more than a pre-determined price for a stock.

Stop, Stop-Limit, and Trailing Stop Orders

Stop Order

A stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order. A buy stop order is entered at a stop price above the current market price. Investors generally use a buy stop order to limit a loss or to protect a profit on a stock that they have sold short. A sell stop order is entered at a stop price below the current market price. Investors generally use a sell stop order to limit a loss or to protect a profit on a stock that they own.

Before using a stop order, investors should consider the following:

- Investors should carefully select the stop price they use for a stop order since short-term market fluctuations in a stock’s price can activate a stop order.

- The stop price is not the guaranteed execution price for a stop order. The stop price is a trigger that causes the stop order to become a market order. The execution price an investor receives for this market order can deviate significantly from the stop price in a fast-moving market where prices change rapidly. An investor can avoid the risk of a stop order executing at an unexpected price by placing a stop-limit order, but the limit price may prevent the order from being executed.

- Different trading venues and firms have different standards for determining whether a stop price has been reached. Some use only last-sale prices to trigger a stop order, while others use quotation prices. Investors should check with their brokerage firms to determine which standard would be used for stop orders.

Stop-Limit Order

A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better). The benefit of a stop-limit order is that the investor can control the price at which the order can be executed.

Before using a stop-limit order, investors should consider the following:

- As with all limit orders, a stop-limit order may not be executed if the stock’s price moves away from the specified limit price, which may occur in a fast-moving market.

- The stop price and the limit price for a stop-limit order do not have to be the same price. For example, a sell stop limit order with a stop price of $3.00 may have a limit price of $2.50. Such an order would become an active limit order if market prices reach $3.00, however the order can only be executed at a price of $2.50 or better.

- Investors should carefully select the stop and limit prices they use for a stop-limit order since short-term market fluctuations in a stock’s price can activate a stop-limit order.

- As with stop orders, different trading venues and firms may have different standards for determining whether the stop price of a stop-limit order has been reached. Some use only last-sale prices to trigger a stop-limit order, while others use quotation prices. Investors should check with their brokerage firms to determine which standard would be used for stop-limit orders.

Trailing Stop Order

A trailing stop order is a stop or stop limit order in which the stop price is not a specific price. Instead, the stop price is either a defined percentage or dollar amount, above or below the current market price of the security (“trailing stop price”). As the price of the security moves in a favorable direction the trailing stop price adjusts or “trails” the market price of the security by the specified amount. However, if the security’s price moves in an unfavorable direction the trailing stop price remains fixed, and the order will be triggered if the security’s price reaches the trailing stop price.

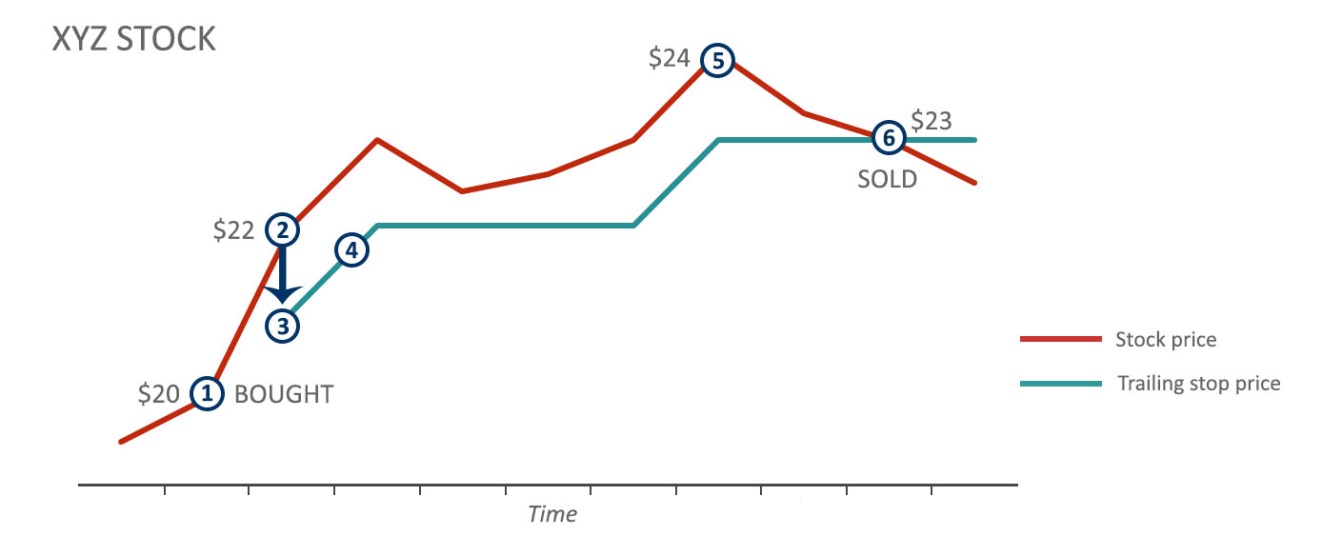

Example of a sell trailing stop order:

1. You buy XYZ stock at $20 per share.

2. XYZ rises to $22.

3. You place a sell trailing stop order with a trailing stop price of $1 below the market price.

4. As long as the price moves in your favor (i.e., increases, because here you are looking to sell it), your trailing stop price will stay $1 below the market price.

5. The price of XYZ peaks at $24 then starts to drop (not in your favor). Your trailing stop price will remain at $23.

6. Shares are sold when XYZ reaches $23, though the execution price may deviate from $23.

Before using a trailing stop order, investors should consider the following:

- Investors should carefully select the trailing stop price they use for a trailing stop order since short-term market fluctuations in a stock’s price can activate a trailing stop order.

- As with stop and stop-limit orders, different trading venues may have different standards for determining whether the stop price of a trailing stop order has been reached. Some exchanges use only last-sale prices to trigger a trailing stop order, while other venues use quotation prices. Investors should check with their brokerage firms to determine which standard would be used for their trailing stop orders.

TIMING RESTRICTIONS AND TRADING INSTRUCTIONS

Market, limit and the various stop orders may include timing restrictions and other trading instructions. The following is a list of common timing restrictions and trading instructions.

Day

Unless an investor specifies a time frame for the expiration of an order, orders to buy and sell a stock are “Day” orders, meaning they are good only during that trading day. Day orders that have been placed but not executed during regular trading hours expire and will not automatically carry over into after-hours trading or the next regular trading day.

Good-Til-Canceled (GTC)

A GTC order is an order to buy or sell a stock that lasts until the order is completed or canceled. Brokerage firms typically limit the length of time an investor can leave a GTC order open. This time frame may vary from broker to broker. Investors should contact their brokerage firms to determine what time limit would apply to GTC orders.

Immediate-Or-Cancel (IOC)

An IOC order is an order to buy or sell a stock that must be executed immediately. Any portion of the order that cannot be filled immediately will be canceled.

Fill-Or-Kill (FOK)

An FOK order is an order to buy or sell a stock that must be executed immediately in its entirety; otherwise, the entire order will be canceled (i.e., no partial execution of the order is allowed).

All-Or-None (AON)

An AON order is an order to buy or sell a stock that must be executed in its entirety, or not executed at all. However, unlike the FOK orders, AON orders that cannot be executed immediately remain active until they are executed or canceled.

On Open

A market or limit order that must be executed when the market opens or re-opens. Any balance not executed as part of the opening trade is canceled.

On Close

A market or limit order that must be executed at the closing price. Any balance not executed as part of the closing trade is canceled.

RELATED INFORMATION

For additional information relating to the types of orders investors may use to buy or sell stock or how the markets work in general, please review our “How the Markets Work” on Investor.gov.