Other

EDGAR—Filing Fee Beta

Sept. 14, 2023

The SEC is making available an EDGAR Filing Fee Beta environment, from October 4, 2023 to December 22, 2023, for filers to test the technical and structured data aspects of the Filing Fee Disclosure and Payment Methods Modernization rule (PDF).

The Filing Fee Beta contains the Fee Exhibit Preparation Tool (FEPT) that includes features such as prompts, explanations, and automated calculations to produce a filing fee exhibit (EX-Filing Fees) in submission-ready format. The Filing Fee Beta also contains the ability to submit an Inline XBRL filing fee exhibit created by third-party tools.

This is the only Filing Fee Beta that SEC staff will make available to filers, therefore, SEC staff encourages all filers, including accelerated filers, to participate before the Filing Fee Beta closes on December 22, 2023.

Quick Links. Filing Fee Beta User Guide (PDF, 1.3 mb) | Filing Fee Beta | Test Cases (PDF, 0.5 mb) | Filing Fee Taxonomy (XSD, 0.2 mb) | Description of Technical Specifications (PDF, 1.5 mb) | Technical Specifications (ZIP, 5.8 mb)

On this page:

- Filing Fee Beta participation

- Accessing the Filing Fee Beta

- Important materials for testing in Filing Fee Beta

- Providing feedback through the Filing Fee Beta Evaluation Form

- Filing

- Account funding

- Important notes about the Filing Fee Beta

- Notifications

- Resources for using the Fee Exhibit Preparation Tool and preparing an Inline XBRL filing fee exhibit (EX-FILING FEES)

- Filing Fee Beta XBRL Exhibit Public Test Suite

- Training videos

- Frequently asked questions

- About filing fee modernization

- Filing Fee Beta release notes

- Quick links

Filing Fee Beta Participation

To participate, filers should send an email to FilingFeeBetaFeedback@sec.gov no later than December 8, 2023, that:

- Includes the filer’s name and EDGAR Central Index Key (CIK) number, and

- Is sent from the email address that corresponds to the filer’s Contact for EDGAR Information, Inquiries and Access Code (EDGAR Contact) listed in EDGAR.

Filers should expect to receive an email from SEC staff within 24 hours upon staff’s receipt of the email indicating interest.

Accessing the Filing Fee Beta

Filing Fee Beta participants may access the Filing Fee Beta with an EDGAR Central Index Key (CIK) number and valid EDGAR credentials.

The Filing Fee Beta will be available from October 4, 2023, until December 22, 2023, during EDGAR business hours, Monday through Friday, except federal holidays.

If you make changes to your EDGAR account, those changes may take up to five business days to be reflected on the Filing Fee Beta. Please plan accordingly.

If you have trouble accessing the Filing Fee Beta, please contact Filer Support at 202-551-8900, option #3.

Important Materials for Testing in Filing Fee Beta

Participants should refer to all of the following SEC staff-provided materials when testing in the Filing Fee Beta:

- User Guide (PDF, 1.3 mb)

- Test cases (PDF, 0.8 mb)

- Taxonomy (XSD, 0.2 mb)

- Description of technical specifications (PDF, 1.5 mb)

- Technical specifications (ZIP, 5.8 mb)

Providing Feedback Through the Filing Fee Beta Evaluation Form

Participants may submit feedback through the online Filing Fee Beta Evaluation Form, accessible on the EDGARLink Online Beta website. Upon receipt of the form, SEC staff may contact the participant via email (from FilingFeeBetaFeedback@sec.gov to the filer’s administrative contact email address on file in EDGAR) if additional information is required.

In addition to general feedback, SEC staff encourages filers to provide feedback regarding any unexpected system behavior, unexpected errors or warnings encountered, and/or other such technical issues experienced.

Updates made to the Filing Fee Beta will be published on the Filing Fee Beta EDGARLink Online main page under release notes each month.

Filer Support is available to support participants with Filing Fee Beta login and access issues. All other technical issues experienced with the Filing Fee Beta, or with general filing fee questions during the testing period, should be reported through the Filing Fee Beta Evaluation form.

Filing

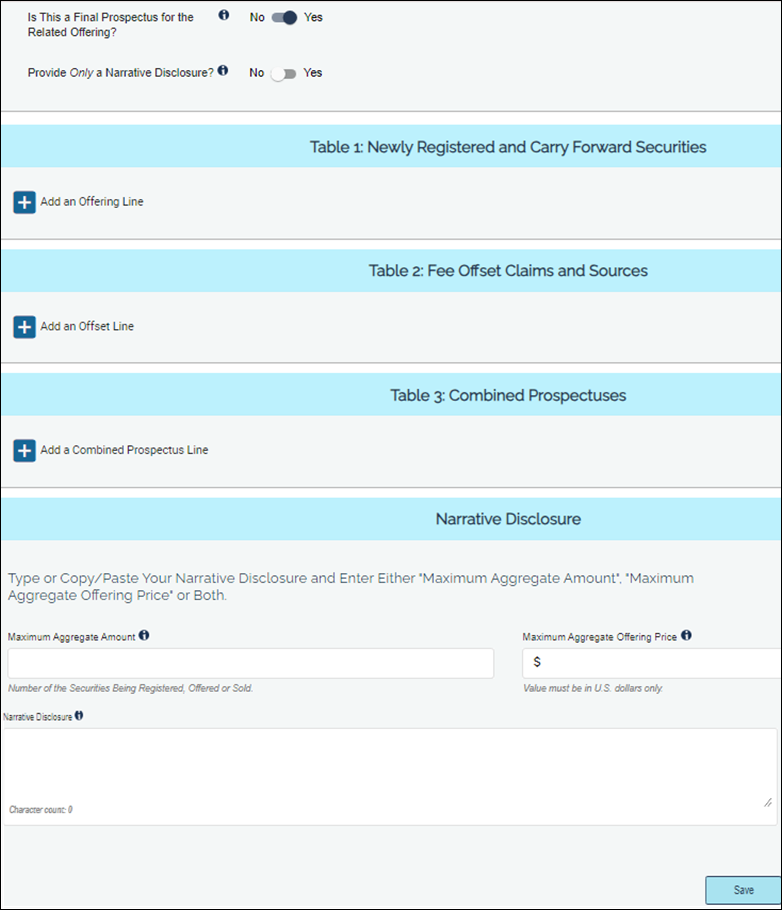

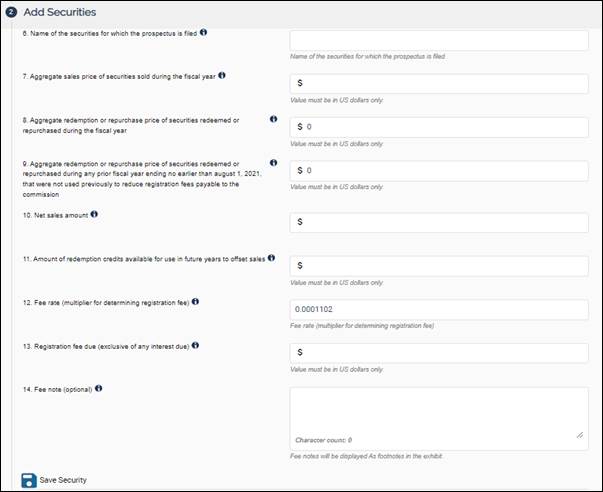

The Filing Fee Beta introduces the new Fee Exhibit Preparation Tool (FEPT) for filers. This tool will construct an Inline XBRL Filing Fee Exhibit (EX-FILING FEES) and automatically attach the exhibit to filings on the EDGARLink Online Beta website.

Participants are encouraged to use this tool to prepare their Filing Fee Beta filing fee exhibits. Exhibits constructed in the Filing Fee Beta should only be submitted on the Filing Fee Beta; they cannot be submitted on production EDGAR.

Participants may also elect to submit their own Filer-Constructed Inline XBRL exhibits on the Filing Fee Beta via EDGARLink Online Beta. Participants may not file these exhibits on production EDGAR.

Inline XBRL Filing Fee Exhibit support will be available in January 2024.

Participants may submit TEST filings using the EDGARLink Online Beta website. To experience full functionality and behavior, however, participants are encouraged to primarily submit LIVE filings. While LIVE filings will not be disseminated during the Filing Fee Beta, participants may preview their exhibits by clicking the “preview” button at the bottom of the Fee Exhibit Preparation Tool page, after the necessary data fields have been completed.

Account Funding

The SEC staff will place fictitious funds in every Filing Fee Beta account for participants to use in testing. SEC staff will add fictitious funds to accounts periodically. When participants submit fee-bearing filings on the Filing Fee Beta, they will reduce the fictitious funds in their accounts. If participants wish to test ‘inadequate funds’ functionality, they may reduce their Filing Fee Beta accounts by submitting fee-bearing filings on the Filing Fee Beta.

The fictitious funds made available in the Filing Fee Beta System are not transferrable to the EDGAR system and cannot be recouped or refunded in anyway. Please see the Frequently Asked Questions section for more information about the fictitious funds to be used during Filing Fee Beta testing.

If you notice your CIK does not have adequate fictitious funds to complete your testing, please notify the SEC at FilingFeeBetaFeedback@sec.gov. Please allow up to five business days for SEC staff to add fictitious funds to your account. Depending on email volume, we may not be able to respond directly to your request, but fictitious funds will be added to your account as soon as possible.

Note: DO NOT send any monies to US Bank to fund the Filing Fee Beta account. Any funds received by US Bank will either be returned or applied to your EDGAR CIK.

Important Notes About the Filing Fee Beta

- Filers cannot meet any legal filing obligations by use of the Filing Fee Beta.

- The Filing Fee Beta is a U.S. government system and is subject to the same requirements, provisions, and monitoring as any other government system.

- EDGAR Beta websites listed in instructions for the Filing Fee Beta are limited to use in connection with the Filing Fee Beta, unless otherwise noted.

- Emails to FilingFeeBetaFeedback@sec.gov must be sent from the contact email address currently on file in EDGAR. Emails received from unrecognized email addresses will not be maintained or addressed.

- The Filing Fee Beta will display a banner at the top of each page.

- Filers who do not see the Filing Fee Beta banner should check to see if they are using the correct website.

- The Filing Fee Beta System is not production capable.

- The Filing Fee Beta is directly related to Fee-Bearing submissions covered by the Filing Fee Modernization Final rule. Filers may find certain functionality, such as funding their Filing Fee Beta account, and submitting submission types not subject to the new Filing Fee Modernization rule may or may not work as expected or intended.

- The Filer Management function will not be available in the Filing Fee Beta. Updates to filer information must be done in EDGAR. A company update to change the notification email address will not be available in Filing Fee Beta. The contact information in EDGAR must be the same as Filing Fee Beta, and vice versa.

- Pay.Gov is not available for EDGAR Filing Fee Beta. Please see the “Account Funding” section for instructions on how accounts will be funded.

- System maintenance may result in periodic unavailability of the Filing Fee Beta. SEC staff will post a notice to inform filers if the system will be unavailable for an extended period of time. The Filing Fee Beta will not be extended due to periodic system unavailability.

- The SEC reserves the right to revoke access to the Filing Fee Beta in accord with 232.15.

- The Filing Fee Beta is provided for testing purposes only.

Notifications

Filing Fee Beta notifications will appear very similar to EDGAR notifications, however, Filing Fee Beta notifications will typically display a “BETA” banner. Filers who participate in testing should exercise abundant caution when reviewing system notifications in order to distinguish EDGAR notifications from Filing Fee Beta notifications; both notifications will be sent to the email address on file in EDGAR. Please be aware that a company update to change the notification email address is not available in the Filing Fee Beta.

If you cannot determine whether the notification was sent by the Filing Fee Beta, please submit the feedback form. If you encounter an urgent issue, please send an email to FilingFeeBetaFeedback@sec.gov, or call Filer Support at 202-551-8900, option #3.

Resources for using the Fee Exhibit Preparation Tool and preparing an Inline XBRL filing fee exhibit (EX-FILING FEES)

Filers can construct EX-FILING FEES exhibits without using the EDGAR-provided Fee Exhibit Preparation Tool (or FEPT). Please note that if filers opt to use the FEPT, they should continue to verify the accuracy of the generated tagged fee exhibits.

Each example provided below includes the data elements that correspond to the rule selected, the validations performed, and the system generated warning/informational messages. These examples and related commentary are provided solely for purposes of preparing an Inline XBRL filing fee exhibit (EX-FILING FEES) and should not be relied upon or construed as guidance for other purposes.

Registering new securities on 1933 Act filings

Submit an initial registration statement with offerings in reliance on Rule 457(a)

Rule 457(a): For an offering line referencing 457(a), an issuer will register (and pay the fee for) a specific number of shares and not a specific dollar amount. For offering lines referencing this rule, Amount Registered and Proposed Maximum Offering Price Per Unit are multiplied together for calculating the Maximum Aggregate Offering Price. If the number of shares or other units of securities to be offered is increased by an amendment filed prior to the effective date of the registration statement, an additional filing fee, computed based on the offering price of the additional securities, shall be paid.

Below are steps to submit an initial registration statement in EDGAR with offerings in reliance of Rule 457(a):

- Select a fee bearing submission, for example S-3, from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for

S-3 displays. - Enter the CIK and CCC on the EDGARLink Online Main page. Complete all the required fields for the S-3 submission on the Main page.

- Navigate to the “Documents” tab and select the “Attach Inline XBRL Fee Tagging exhibit?” check box. A Warning dialog box opens and displays the following message.

“Please choose YES only if... ... you would like to attach the fee exhibit in a structured format (Inline XBRL) to the submission or access the Fee Exhibit Preparation Tool to generate and attach the filing fees exhibit. The Fee Exhibit Preparation Tool includes information for fee calculation in a structured format. The Inline XBRL exhibit attachment will be automatically attached to your EDGARLink Online submission. If this is not intended, please choose NO.”

- Select “Yes” as a response to the warning message that displays in the dialog box.

The “Fee Exhibit Preparation Tool” hyperlink and the “Payor Info” tab is displayed on the EDGARLink Online interface, in place of the fee header tabs: “Fee Offsets” and “Offerings & Fees.”

- Enter the Payor CIK and Payor CCC, if applicable.

- Select the “Fee Exhibit Preparation Tool” hyperlink to access the tool. FEPT opens and displays the Terms of Use.

- To accept the Terms of Use, select the checkbox that displays at the bottom of the “Fee Exhibit Preparation Tool Terms of Use” dialog box. On selecting the checkbox, the [Close] button is enabled.

- Select the [Close] button to close the dialog box and view FEPT. The tool pre-populates values for Filer CIK, Submission Type, Form Type, and Name of Filer.

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

- Select “Rule 457(a)” from the “Fee Calculation or Carry Forward Rule” drop down list.

- Ensure that the “Fees To Be Paid” option is selected when adding a new offering line.

Note: On initial registration statements, the “Fees To Be Paid” option is selected by default. - Select the type of securities to be offered using this registration statement from the “Security Type” drop down list. The options displayed are based on the Fee Calculation Rule selected.

- Enter a title of the class of securities to be offered using this registration statement in the “Security Class Title” field.

- Enter the number of shares initially being registered in the “Amount Registered” field.

- Enter the price per share in the “Proposed Maximum Offering Price per Unit” field.

- FEPT automatically calculates the “Maximum Aggregate Offering Price” for each class of securities as the product of the “Amount Registered” and the “Proposed Maximum Offering Price Per Unit.”

- FEPT automatically calculates the “Amount of Registration Fee” by multiplying the “Maximum Aggregate Offering Price” by the current “Fee Rate.”

- Enter a fee note (optional) to disclose specific details relating to the fee calculation as necessary to clarify the information presented for a particular offering line in Table 1.

- Select the [Save] button. “Table 1: Newly Registered and Carry Forward Securities” displays the newly added offering line in reliance of Rule 457(a). Repeat steps 9 to 19 to add additional offering lines in Table 1.

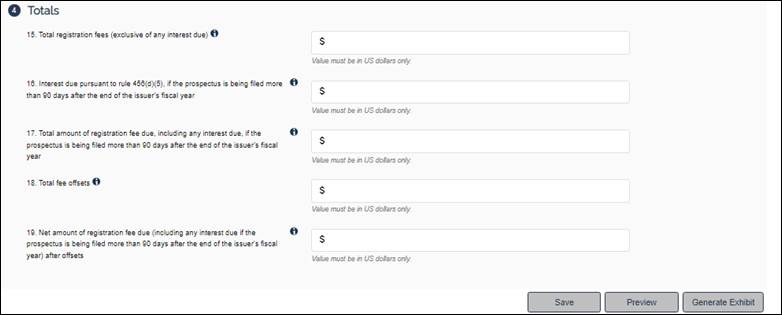

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

- Select the [Generate Exhibit] button located at the bottom of the screen. Note that this button is enabled only when a line of data is saved.

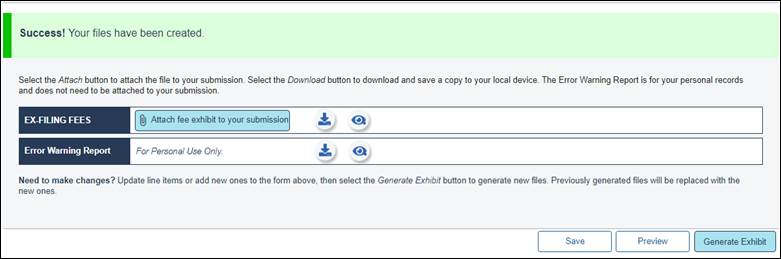

- FEPT displays the following message: “Success! Your files have been created.”

- Select the [Attach fee exhibit to your submission] button to attach the fee exhibit to the EDGARLink Online submission.

- The “Attach file to ELO submission?” dialog box is displayed.

- Select the [Continue] button to attach the exhibit to the submission. Alternatively, select the [Close] button to close the dialog box.

- A message displays confirming that the EX-FILING FEES has been successfully attached to the submission.

- The EX-FILING FEES exhibit is displayed on the “Documents” tab of the EDGARLink Online submission.

- Attach the S-3 primary document.

- Enter data into the Notifications, Module/Segment, and Payor Info as applicable.

- When your submission has been compiled, you can transmit your LIVE filing:

- Click the [SUBMIT] button on the open submission. The Confirmation page appears.

- Click the [Transmit LIVE Submission] button.

Once you click this button, EDGAR will transmit your submission.

Submit a pre-effective amendment with additional securities and reference previously paid offerings

Rule 457(a) requires a registrant to pay an additional filing fee with any pre-effective amendment in which the registrant seeks to increase the number of shares or other units of securities to be offered and prohibits refunds once a registration statement is filed.

Below are steps to submit a pre-effective amendment in EDGAR to register additional securities in reliance of Rule 457(a), and reference previously paid offerings:

- Select S-3/A from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for S-3/A displays.

- Enter the CIK, CCC, and File Number on the EDGARLink Online Main page. Complete all the required fields for the S-3/A submission on the Main page.

- Access FEPT by following steps 3 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457 (a).

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities” on FEPT.

- Select “Rule 457(a)” from the “Fee Calculation or Carry Forward Rule” drop down list.

- To register additional securities to that previously paid under Rule 457(a) for the same class of securities previously registered, select the “Fees To Be Paid” option under “Specify the Fee Transaction.”

- Enter the additional shares in the “Amount Registered”. Since the price per share is the same as the initial S-3 registration, enter the amount in the “Proposed Maximum Offering Price Per Unit.” FEPT automatically calculates the “Maximum Aggregate Offering Price” for each class of securities as the product of the “Amount Registered” and the “Proposed Maximum Offering Price Per Unit”.

- FEPT automatically calculates the “Amount of Registration Fee” by multiplying the “Maximum Aggregate Offering Price” by the current “Fee Rate.”

- Enter a fee note (optional) to disclose specific details relating to the fee calculation as necessary to clarify the information presented for a particular offering line in Table 1.

- To register all fees previously paid for securities from the original registration, follow the steps below.

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

- Select “Rule 457(a)” from the “Fee Calculation or Carry Forward Rule” drop down list.

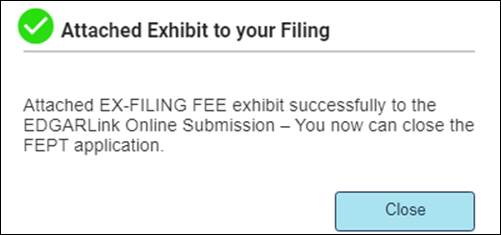

- Select the “Fees Previously Paid” option under “Specify the Fee Transaction” to enter securities already included on the prior S-3 filing for the registration.

- Select the type of securities that were registered using the S-3 registration statement from the “Security Type” drop down list. The options displayed are based on the Fee Calculation Rule selected, as applicable.

- Enter the title of the class of securities that were registered using this registration statement in the “Security Class Title” field.

IMPORTANT: Enter the same title as entered on the initial registration; EDGAR performs a character-by-character match on the security title, and uses this input along with the security type and file number to validate the amounts entered for “Maximum Aggregate Offering Price” and “Amount of Registration Fees” for each Fees Previously Paid offering line. - Enter the number of shares that were registered in the “Amount Registered” field.

- Enter the same price per share as on the initial registration in the “Proposed Maximum Offering Price per Unit” field.

- FEPT automatically calculates the Maximum Aggregate Offering Price for each class of securities as the product of the “Amount Registered” and the “Proposed Maximum Offering Price Per Unit”.

- FEPT automatically calculates the “Amount of Registration Fee” by multiplying the “Maximum Aggregate Offering Price” by the current “Fee Rate.”

Note: For previously paid line(s), this field might not equal Aggregate * Fee Rate if the previously paid shares were registered across multiple fiscal years or if other fee variables in the “Previously Paid” lines have been updated subsequent to the initial fee payment. As a result, you can override the automatically calculated “Amount of Registration Fee” for the previously paid line. - Enter a fee note (optional) to disclose specific details relating to the fee calculation as necessary to clarify the information presented for a particular offering line in Table 1.

- Select the [Save] button. The Fees Previously Paid offering line is displayed in “Table 1: Newly Registered and Carry Forward Securities.” Beneath the Table, the “Total Fees Previously Paid” amount is pre-populated.

IMPORTANT: The amount displayed is the sum of the prior actual payments (not the sum of the registration fees due for securities previously registered) made to the Commission for the registration. Transactions such as offsets, which do not require the payment of new funds to the Commission, are excluded from this amount.

Follow the steps below if you want to edit this amount:- Select the pen icon adjacent to the amount.

- In the “Total Fees Previously Paid” dialog box, edit the amount displayed.

- Click the [Submit] button. FEPT displays the following warning if the entered amount does not match the amount in the EDGAR database for the registration (file number).

Warning: The Total Fees Previously Paid amount $33.00 is not the aggregate of the prior payments made to the Commission.

The “Total Fees Previously Paid” amount appears under “Table 1: Newly Registered and Carry Forward Securities” and on the “Fee Totals” menu located on the left of the FEPT interface.

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

- Follow steps # 19 to 28 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a) to generate the EX-FILING FEES exhibit, attach the EX-FILING FEES to the EDGARLink Online S-3/A submission, and submit the S-3/A filing to EDGAR.

Register new securities on an “unallocated basis” in reliance on Rule 457(o)

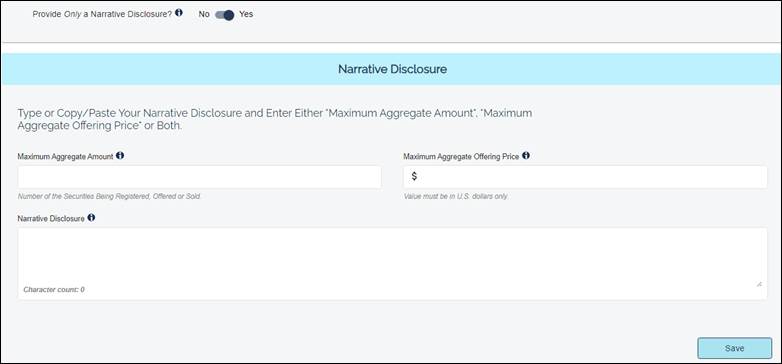

Rule 457(o): “Where an issuer registers an offering of securities, the registration fee may be calculated on the basis of the maximum aggregate offering price of all the securities listed in the “Calculation of Registration Fee” table. The number of shares or units of securities need not be included in the “Calculation of Registration Fee” Table. If the maximum aggregate offering price increases prior to the effective date of the registration statement, a pre-effective amendment must be filed to increase the maximum dollar value being registered and the additional filing fee shall be paid.”

See e.g., Form N-2 Calculation of Filing Fees Tables instruction 2.A.iii.b. (“When registering two or more classes of securities pursuant to General Instruction A.2 of this Form for an offering pursuant to Rule 415(a)(1)(x) under the Securities Act [17 CFR 230.415(a)(1)(x)] and where this Form is not filed by a Well-Known Seasoned Issuer that elects to defer payment of fees as permitted by Rule 456(b), Rule 457(o) permits the calculation of the registration fee to be based on the maximum aggregate offering price of all the newly registered securities listed in Table 1. In this event, Table 1 must list each of the classes of securities being registered, in tandem with its security type, but may omit the proposed maximum aggregate offering price for each class. Following that list, Table 1 must list the security type ‘Unallocated (Universal) Shelf’ and state the maximum aggregate offering price for all of the classes of securities on a combined basis.”)

Below are steps to register new securities on an “unallocated basis” in reliance on Rule 457(o), and submit the filing in EDGAR:

- Select N-2 from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for N-2 displays.

- Enter the CIK and CCC on the EDGARLink Online Main Page. Complete all the required fields for the N-2 submission on the Main page.

- Access FEPT by following steps 3 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457 (a)

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

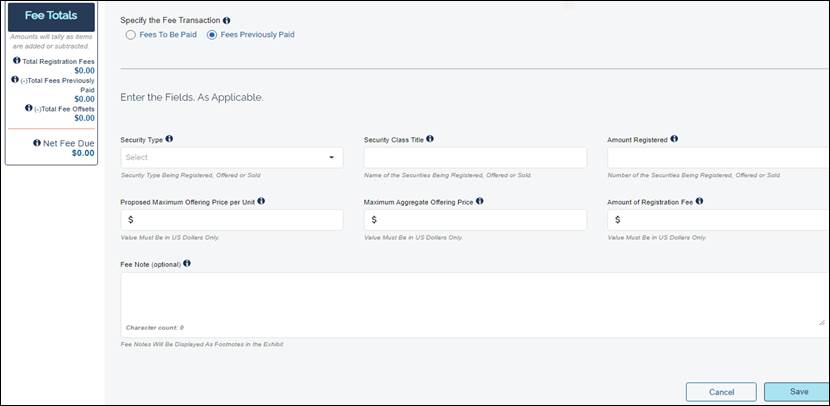

- Select “Rule 457(o)” from the “Fee Calculation or Carry Forward Rule” drop down list.

- Move the slider to the “Yes” position as a response to the “Unallocated (Universal) Shelf” field. FEPT automatically selects “Unallocated (Universal) Shelf” as the Security Type.

- To include the three classes of securities (sub-items) for “Unallocated (Universal) Shelf”:

- Select an option from the “Security Type” drop down list. Enter the “Security Class Title.”

Note: Because the Maximum Aggregate Offering Price field is optional for the sub-items, this field can be left blank for the three classes of securities. - Select the + icon to add another security. Select an option from the “Security Type” drop down list. Enter the Security Class Title.

- Select the + icon to add another security. Select an option from the “Security Type” drop down list. Enter the “Security Class Title.”

- Select an option from the “Security Type” drop down list. Enter the “Security Class Title.”

- Enter the Maximum Aggregate Offering Price for all three classes of securities on a combined basis on the “Unallocated (Universal) Shelf” line. FEPT automatically calculates the Amount of Registration Fees by multiplying the “Maximum Aggregate Offering Price” by the current “Fee Rate.”

- Enter a fee note (optional) to disclose specific details relating to the fee calculation as necessary to clarify the information presented for a particular offering line in Table 1.

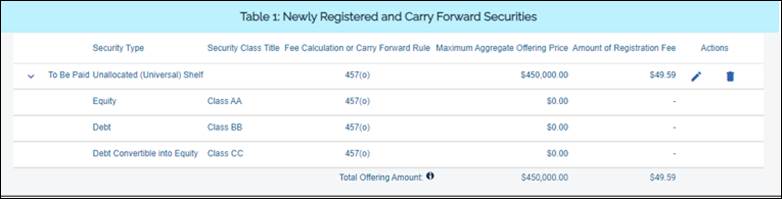

- Click the [Save] button. The Fees To Be Paid “Unallocated (Universal) Shelf” offering line, with the three classes of securities is displayed in “Table 1: Newly Registered and Carry Forward Securities.”

The “Total Offering Amount” (sum of the maximum aggregate offering price for both the newly registered and carry forward securities) and the “Total Registration Fees” (the aggregate registration fee for the newly registered securities) amounts are displayed under Table 1. - The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid (zero since it is not applicable)

- Total Fee Offsets (zero since no offsets are being claimed)

- Net Fee Due

- Follow steps # 19 to 28 documented in Submit an initial registration statement with offerings in reliance of Rule 457(a) to generate the EX-FILING FEES exhibit, attach the EX-FILING FEES to the EDGARLink Online N-2 submission, and submit the N-2 filing to EDGAR.

Register new securities and rely on rule 457(r) /457(s) to defer registration fees

Rule 457(r): See, e.g., Form S-3 Calculation of Filing Fee Tables instruction 2.A.iii.c (“A well-known seasoned issuer registering securities on an automatic shelf registration statement pursuant to General Instruction I.D. of this Form may, at its option, defer payment of registration fees as permitted by Rule 456(b) (§ 230.456(b) of this chapter). If a registrant elects to pay all or any portion of the registration fees on a deferred basis, Table 1 in the initial filing must cite Rule 457(r), as required by Instruction 2.A.ii.c, and identify the classes of securities being registered, in tandem with their respective security types, and the registrant must state, in response to this instruction, that it elects to rely on Securities Act Rules 456(b) and 457(r), but Table 1 does not need to specify any other information with respect to those classes of securities. When the issuer files a post effective amendment or a prospectus in accordance with Rule 456(b)(1)(ii) (§ 230.456(b)(1)(ii) of this chapter) to pay a deferred fee, the amended Table 1 must specify either the dollar amount of securities being registered if paid in advance of or in connection with an offering or offerings or the aggregate offering price for all classes of securities in the referenced offering or offerings and the applicable registration fee, which shall be calculated based on the fee payment rate in effect on the date of the fee payment.”)

Below are steps to rely on Rule 457(r) and defer the registration fees due for an offering:

- Select S-3ASR from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for S-3ASR displays.

- Enter the CIK and CCC on the EDGARLink Online Main Page. Complete all the required fields for the S-3ASR submission on the Main page.

- Access FEPT by following steps 3 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457 (a)

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

- Select “Rule 457(r)” from the “Fee Calculation or Carry Forward Rule” drop down list.

Note: When deferring a fee on this Shelf Registration statement, filers must include the Security Type, Security Class Title, and Fee Rule 457(r), but may leave the other fields blank. Filers must also state in a footnote that they elect to rely on Securities Act Rules 456(b) and 457(r). - Select the type of securities to be offered using this registration statement from the “Security Type” drop down list. The options displayed are based on the Fee Calculation Rule selected, as applicable.

- Enter a title of the class of securities to be offered using this registration statement in the “Security Class Title” field.

- Do not provide values for the following fields “Amount Registered”, “Proposed Maximum Offering Price per Unit” and the “Maximum Aggregate Offering Price” when deferring a fee payment under 457(r). If filers provide a value for any of these fields, FEPT displays the following warning message:

Warning: Filers relying on Securities Act Rules 456(b) and 457(r) to defer a fee payment may omit the Amount Registered, Proposed Maximum Offering Price Per Unit, and Maximum Aggregate Offering Price amount.

- Enter a fee note stating that you choose to rely on Securities Act Rules 456(b) and 457(r) to defer fees.

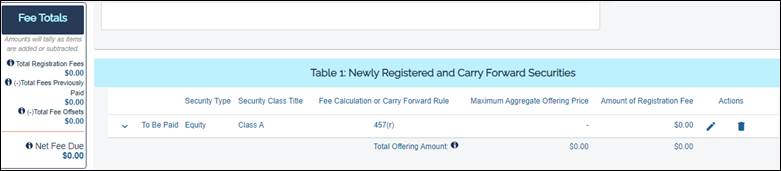

- Click the [Save] button. The Fees To Be Paid offering line with blank/null values are displayed in “Table 1: Newly Registered and Carry Forward Securities”.

- The “Fee Totals” summary values of zero are displayed on the left navigation pane of the FEPT interface:

- Total Registration Fees

- Total Fees Previously Paid (will be zero since it is not applicable)

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

Rule 457(s): See Form SF-3 Calculation of Filing Fees Tables instruction 2.A.iii.b (“Where securities are being registered on this Form SF–3, Rule 456(c) under the Securities Act (§ 230.456(c) of this chapter) permits, but does not require, the registrant to pay the registration fee on a pay-as-you-go basis, and Rule 457(s) under the Securities Act (§ 230.457(s) of this chapter) permits, but does not require, the registration fee to be calculated on the basis of the aggregate offering price of the securities to be offered in an offering or offerings off the registration statement. If a registrant elects to pay all or a portion of the registration fee on a deferred basis, Table 1 must cite Rule 457(s), as required by Instruction 2.A.ii.c, and identify the classes of securities being registered, in tandem with their respective security types, and the registrant must state, in response to this instruction, that it elects to rely on Securities Act Rules 456(c) and 457(s), but Table 1 does not need to specify any other information with respect to those classes of securities. When the issuer amends Table 1 in accordance with Rule 456(c)(1)(ii) (§ 230.456(c)(1)(ii) of this chapter), the amended Table 1 must include either the dollar amount of securities being registered if paid in advance of or in connection with an offering or offerings or the aggregate offering price for all classes of securities referenced in the offerings and the applicable registration fee.”)

Filers who are deferring the payment of registration fees on submission types SF-3 or SF-3/A must include the Security Type, Security Class Title, Fee Rule, and Fee Note, but may leave all the other fields blank. Filers must state in a footnote that they choose to rely on Securities Act Rules 456(c) and 457(s). Follow the steps documented for Rule 457(r) to defer registration fee in reliance of Rule 457(s).

Register new securities and rely on Rule Other and pay no filing fees

Rule Other: Please refer to the relevant form instructions for choosing Rule Other. Select “Rule Other" on FEPT if no more precise Fee Calculation Rule specified by the relevant Form instructions is applicable.

Filers who rely on Rule Other must include the Security Type, Security Class Title, Fee Rule, and Fee Note, but may leave all the other fields blank to the extent not applicable (Amount Registered, Proposed Maximum Offering Price Per Unit, Maximum Aggregate Offering Price, Fee Rate, and Amount of Registration Fee.) Filers must disclose in a footnote specific details needed to clarify their choice of “Rule Other”, including references to the provisions of Rule 457 (e.g., Rule 457(g)) and any other rule that they choose to rely on.

Note: If you enter the values for “Amount Registered” and “Proposed Maximum Offering Price Per Unit,” the system will automatically compute the Maximum Aggregate Offering Price, along with the Amount of Registration Fees.

Register new securities and rely on Rule 457(u) and pay no filing fees

Rule 457(u): If an offering of an indeterminate amount of exchange-traded vehicle securities, as that term is defined in Securities Act Rule 405, is being registered, enter “457(u)”. Separately, state that the registration statement covers an indeterminate amount of securities to be offered or sold and that the filing fee will be calculated and paid in accordance with Rule 456(d) and Rule 457(u).

Filers can register an indeterminate amount of exchange-traded vehicle securities (ETVS) and rely on Rule 457(u) on Form F-1, F-3, S-1, and S-3 and pay fees on an annual deferred net sales basis by submitting the 424I form type.

Note: If the filer attempts to claim a 457(p) offset on an initial filing that registers securities only in reliance on Rule 457(u), EDGAR will generate a warning message. The offsets should only be claimed at the time of the 424I filing when a fee is first due. A 424I filing cannot rely on Rule 457(b) or 0-11(a)(2) to claim an offset.

Register new securities and rely on Rule 457(f) to calculate fees

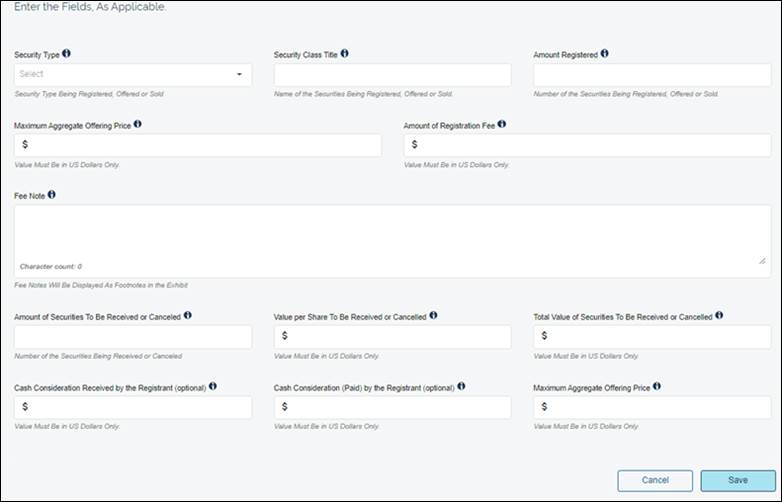

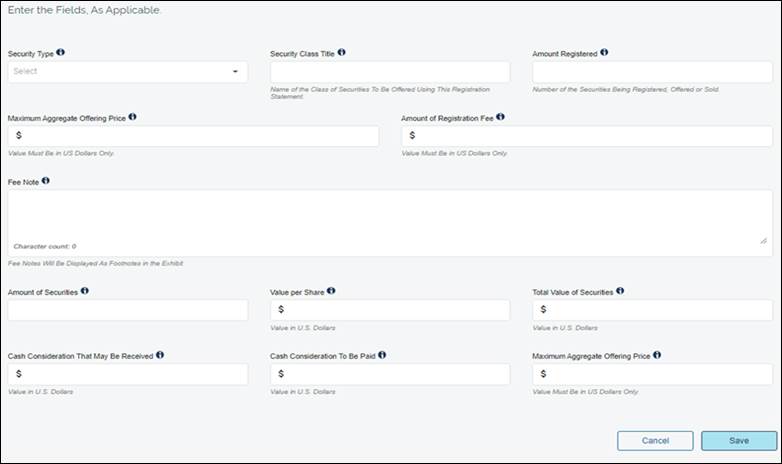

Rule 457(f): For a fee calculated as specified in Rule 457(f), select “457(a)”, “457(o)” or “Other”, as applicable from the “Fee calculation or carry forward rule” drop down and select “Yes” as a response to the “Combine with Rule 457(f)” option.

Separately disclose the amount and value of securities to be received by the registrant, or cancelled upon the issuance of securities registered on this form, and explain how the value was calculated in accordance with Rule 457(f)(1) and (2), as applicable. The explanation must include the value per share of the securities to be received by the registrant or cancelled upon the issuance of securities registered on this form. Also disclose any amount of cash to be paid by the registrant in connection with the exchange or other transaction, and any amount of cash to be received by the registrant in connection with the exchange or other transaction. In accordance with Rule 457(f)(3), a registrant may determine the maximum aggregate offering price for such a transaction by deducting any amount of cash to be paid by the registrant in connection with the exchange or other transaction from, and add any amount of cash to be received by the registrant in connection with the exchange or other transaction to, the value of the securities to be received or cancelled as calculated in accordance with Rule 457(f)(1) and (2), as applicable. Omit from the table the maximum offering price per unit.

Below are steps to register new securities and calculate fees using Rule 457(f):

- Select F-4 from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for F-4 displays.

- Enter the CIK and CCC on the EDGARLink Online Main Page. Complete all the required fields for the F-4 submission on the Main page.

- Access FEPT by following steps 3 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a)

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

- Select “Rule 457(a)”, “Rule 457(o),” or “Rule Other” from the “Fee Calculation or Carry Forward Rule” drop down list.

- Move the slider to the “Yes” position as a response to the “Combine with Rule 457(f)?” field.

- Select the type of securities to be offered using this registration statement from the “Security Type” drop down list. The options displayed are based on the Fee Calculation Rule selected, as applicable.

- Enter a title of the class of securities to be offered using this registration statement in the “Security Class Title” field.

- Enter the number of shares initially being registered in the “Amount Registered” field. This is a required numeric value for 457(a), and an optional value for 457(o), and Other.

- Enter the Maximum Aggregate Offering Price calculated in accordance with Rule 457(f).

- Disclose the following as a 457(f) footnote:

- Amount of Securities To be Received or Cancelled: Enter the number of securities to be received by the registrant or cancelled upon issuance of securities to be registered on the form.

- Value per Share To be Received or Cancelled: Enter the value per share of securities to be received by the registrant or cancelled upon issuance of securities to be registered on the form.

- Total Value of Securities to be Received or Cancelled: The total value of securities to be received by the registrant or cancelled upon issuance of securities registered on the form, as determined pursuant to Rule 457(f)(1) and (f)(2) is automatically calculated as the product of “Amount of Securities To be Received or Cancelled” and the “Value per Share To be Received or Cancelled”.

- Cash Consideration Received by the Registrant: An optional, numeric non-negative value. Enter the amount of cash to be received by the registrant in connection with the exchange or other transaction.

- Cash Consideration (Paid) by the Registrant: An optional, numeric non-negative value. Enter the amount of cash to be paid by the registrant in connection with the exchange or other transaction.

- Fee Note: Disclose specific details relating to the fee calculation as necessary to clarify the information presented in each table, including references to the provisions of Rule 457 under the Securities Act and any other rule being relied upon.

- Click the [Save] button. On initial filings and pre-effective amendments, EDGAR validates that the Maximum Aggregate Offering Price value in 457(f) footnote(s) equals the sum of Maximum Aggregate Offering Price for all lines in Table 1 that reference 457(f) fee note (for example, Rule 457(a), Rule 457(o) and Rule Other). If the amounts do not match, the system displays the following warning message: The "Maximum Aggregate Offering Price" value in the footnote is not equal to the "Maximum Aggregate Offering Price" value for this offering.

- The “Fees To Be Paid” offering line in reliance of Rule 457(a), Rule 457(o), or Rule Other is displayed in “Table 1: Newly Registered and Carry Forward Securities”. The “Total Offering Amount” (sum of the maximum aggregate offering price for both the newly registered and carry forward securities) and the “Total Registration Fees” (the aggregate registration fee for the newly registered securities) amounts are displayed under Table 1.

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

Submitting transactional information on 1934 Act filings

Submit securities-related transactional information requiring a fee Using Rule 0-11

Rule 0-11: Filing fees for certain acquisitions, dispositions, business combinations, consolidations, or similar transactions.

This filing must be accompanied by a fee payable to the Commission as and to the extent required by §240.0-11(b).

Below are steps to submit securities-related transactional information requiring a fee using Rule 0-11:

- Select a Schedule, for example SC TO-I, from the “EDGARLink Online Submission Type Selection” page. The EDGARLink Online Main page for

SC TO-I displays. - Enter the CIK and CCC on the EDGARLink Online Main Page. Complete all the required fields for the SC TO-I submission on the Main page.

- Access FEPT by following steps 3 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a)

- Select the + icon to add a transaction line under “Table 1: Transaction Valuation”.

Note: For PREM14A/C and PRER14A/C submissions, FEPT displays “Table 1: Proposed Maximum Aggregate Value of Transaction.” - Ensure that the “Fees To Be Paid” option is selected by default when adding a new transaction valuation line.

Note: For amended filings, at least one “Fees Previously Paid” line must be included. - Enter the “Transaction Valuation” amount and an explanation in the “Transaction Valuation Explanation” text block. FEPT automatically calculates the “Amount of Filing Fee” as the product of the “Transaction Valuation” and the current “Fee Rate.”

Note: Filers can override the system computed value for the “Amount of Filing Fee” field and put in a zero-transaction valuation for Schedules and Rule 13e-1. Additionally, filers must also include a footnote explaining why they owe no money. For example, registered closed-end investment companies that operate in a “master-feeder” structure are relieved of fees in certain circumstances. See Ironwood Multi-Strategy Fund LLC and Ironwood Institutional Multi-Strategy Fund LLC, SEC No-Action Letter (pub. avail. April 19, 2017). FEPT displays the following warning when filers enter a zero-transaction valuation:

- “The Amount of Filing Fee is not the product of Transaction Valuation and Fee Rate. Please explain if the Issuer is availing itself of the SEC staff’s no-action relief in Ironwood Multi-Strategy Fund LLC and Ironwood Institutional Multi-Strategy Fund LLC, SEC No-Action Letter (pub. avail. April 19, 2017) in the accompanying footnote.”

- “The Amount of Filing Fee is not the product of Transaction Valuation and Fee Rate. Please explain if the Issuer is availing itself of the SEC staff’s no-action relief in Ironwood Multi-Strategy Fund LLC and Ironwood Institutional Multi-Strategy Fund LLC, SEC No-Action Letter (pub. avail. April 19, 2017) in the accompanying footnote.”

- Select the [Save] button. The “Fees To Be Paid” transaction valuation line is displayed in “Table 1: Transaction Valuation.”

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Fees Due for Filing

- Total Fees Previously Paid (will be zero since it is not applicable)

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

- Follow steps # 19 to 28 documented in Submit an initial registration statement with offerings in reliance on Rule 457 (a) to generate the EX-FILING FEES exhibit, attach the EX-FILING FEES to the EDGARLink Online SC TO-I submission, and submit the filing to EDGAR.

Carry forward securities from an earlier registration statement

Carry forward...

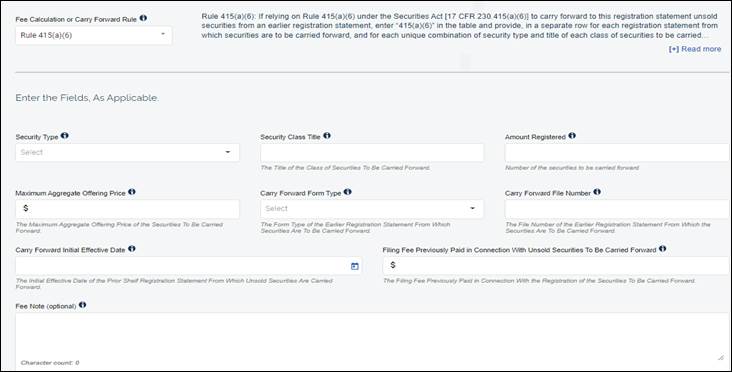

Rule 415(a)(6): If relying on Rule 415(a)(6) under the Securities Act (§230.415(a)(6) of this chapter) to carry forward to this registration statement unsold securities from an earlier registration statement, enter “415(a)(6)” in the table and provide, in a separate row for each registration statement from which securities are to be carried forward, and for each unique combination of security type and title of each class of securities to be carried forward, the following information:

- The security type of the class of securities to be carried forward;

- The title of the class of securities to be carried forward;

- The amount of securities being carried forward expressed in terms of the number of securities (under the column heading “Amount Registered”) and the amount of the maximum aggregate offering price, as specified in the fee table of the earlier filing, associated with those securities (under the column heading “Maximum Aggregate Offering Price”) or, if the related filing fee was calculated in reliance on Rule 457(o), the amount of securities carried forward expressed in terms of the maximum aggregate offering price (under the column heading “Maximum Aggregate Offering Price”);

- The form type, file number, and initial effective date of the earlier registration statement from which the securities are to be carried forward; and

- The filing fee previously paid in connection with the registration of the securities to be carried forward.

Below are steps to carry forward securities from an expiring prior registration statement using FEPT:

- Access FEPT on an S-1 submission by following steps 1 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a).

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities”.

- Select a rule from the “Fee Calculation or Carry Forward Rule” drop down list, and enter all the applicable fields for a “Fees To Be Paid” Offering line.

- Select the + icon to add a carry forward line under “Table 1: Newly Registered and Carry Forward Securities” and select “Rule 415(a)(6)” from the “Fee Calculation or Carry Forward Rule” drop down list.

- Select the type of securities to be carried forward from the prior registration in the “Security Type” drop down list.

- Enter the title of the class of securities to be carried forward from the prior registration in the “Security Class Title” field.

- Enter the number of shares being carried forward in the “Amount Registered” field. This field is optional if the prior registration relied on Rule 457(o).

EDGAR will validate that the amount entered is a numeric value that is less than or equal to number of securities previously registered for the 415(a)(6) carryforward for the same security title and security type using the file number provided. The system will generate the following warning if you enter an “Amount Registered” value that exceeds the consolidated/cumulative number registered on the prior registration statement:- Warning: Value for the Carry forward Amount Registered is invalid because the amount {carryForwardAmtSecuritiesRegistered} exceeds the number of securities previously registered {regAmtSecurities} for the Security Type {secType} and Security Title {secTitle} for the Carry forward File Number {carryForwardFileNumber}.

- Warning: Value for the Carry forward Amount Registered is invalid because the amount {carryForwardAmtSecuritiesRegistered} exceeds the number of securities previously registered {regAmtSecurities} for the Security Type {secType} and Security Title {secTitle} for the Carry forward File Number {carryForwardFileNumber}.

- Enter the “Maximum Aggregate Offering Price” to be carried forward from the prior registration in the corresponding field. This field is required if the prior registration relied on Rule 457(o).

EDGAR will validate that it is a numeric value that is less than or equal to Maximum Aggregate Offering Price previously registered on the prior shelf registration statement for the same security type and security title using the file number provided. The system will generate the following warning if you enter a Maximum Aggregate Offering Price value that exceeds the consolidated/cumulative number registered on the prior registration statement:- Warning: Value for the Carry forward Maximum Aggregate Offering Price (MAOP) amount {carryForwardMAOP} is invalid because it exceeds the MAOP registered previously on the prior registration statement ${MAOPReg} for the Security Type {secType}, Security Title {secTitle}, and File Number {carryForwardFileNumber}.

Note: If the “Amount Registered” and the “Maximum Aggregate Offering Price” value specified relates to a registration that relied on 457(r) or 457(s), then the system will not perform this validation. Instead, the system will generate an informational message stating that the amount of securities carried forward cannot be greater than the amounts registered on the prior filing.

- Warning: Value for the Carry forward Maximum Aggregate Offering Price (MAOP) amount {carryForwardMAOP} is invalid because it exceeds the MAOP registered previously on the prior registration statement ${MAOPReg} for the Security Type {secType}, Security Title {secTitle}, and File Number {carryForwardFileNumber}.

- Select the form type of the earlier registration statement from which securities are to be carried forward from the “Carry Forward Form Type” drop down list, for example Form S-3.

- Enter the file number of the earlier registration statement from which the securities are to be carried forward. If the prior registration statement has both Securities Act file number and Investment Company Act (811-) file number, the Securities Act file number should be reported in the “Carry Forward File Number” field.

- Using the date picker, select the initial Effective Date of the earlier registration statement from which the securities are to be carried forward.

EDGAR will validate that the “Carry Forward Initial Effective Date” provided matches with the system records of the registration’s Effective Date. If the effective dates do not match, the system generates the following warning message:- Warning: Value for the Carry Forward Initial Effective Date

{CfwdInitialEffectiveDate} is invalid because the earlier registration’s effective date was not found in the EDGAR database.

-

Note: Some 33 Act registration statements are automatically effective and do not have an associated EFFECT submission type. EDGAR will consider the Filing Date to be the Effective date in these instances.

When specifying the date, ensure that the “Carryforward Initial Effective date” is not more than three years from the initial filing date of the current registration statement (for example, S-1 in this scenario). If the initial filing date of this replacement registration is three years after the “Carryforward Initial effective Date”, the system will generate the following warning message:

Warning: The Carry Forward Initial Effective Date {CfwdInitialEffectiveDate} is invalid because the date specified is more than three years from the initial filing date of the current registration statement {regInitialFilingDate}. Please provide a Carry Forward Initial Effective Date that is less than or equal to three years from the initial filing date of the current registration statement.

- Warning: Value for the Carry Forward Initial Effective Date

- Enter the filing fee previously paid in connection with the registration of the securities to be carried forward.

- Enter a fee note (optional) to disclose specific details relating to the carry forward line in Table 1.

- Select the [Save] button. “Table 1: Newly Registered and Carry Forward Securities” displays the newly added “Fees To Be Paid” offering line and the carry forward line.

The “Total Offering Amount” (sum of the maximum aggregate offering price for both the newly registered and carry forward securities) and the “Total Registration Fees” (the aggregate registration fee for the newly registered securities) amounts are displayed under Table 1. - The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid (zero since it is not applicable)

- Total Fee Offsets (zero since no offsets are being claimed)

- Net Fee Due

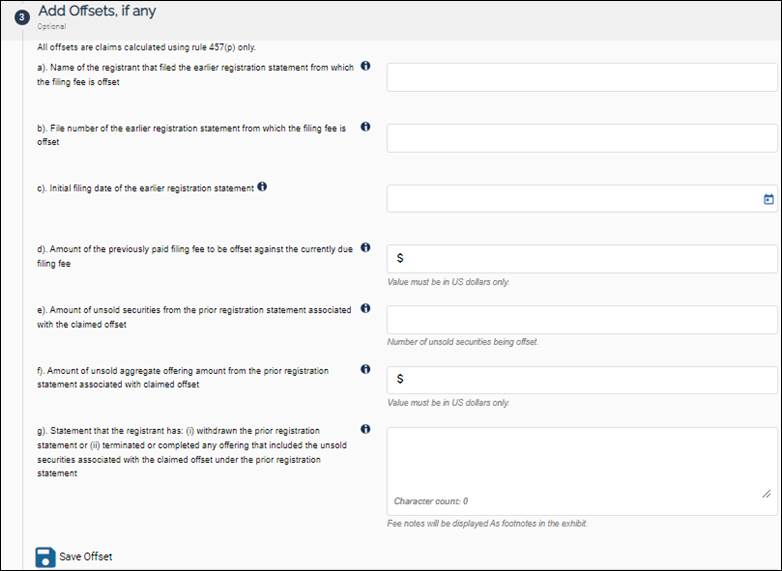

Claiming offset(s)

Claiming offset(s) from terminated offerings for the registration of new securities through Rule 457(p)

Rule 457(p):Where all or a portion of the securities offered under a registration statement remain unsold after the offering’s completion or termination, or the withdrawal of the registration statement, the aggregate total dollar amount of the filing fee associated with those unsold securities (whether computed under Rule 457(a) or Rule 457(o)) may be offset against the total filing fee due for a subsequent registration statement or registration statements. The subsequent registration statement(s) must be filed within five years of the initial filing date of the earlier registration statement, and must be filed by: the same registrant (including a successor entity within the meaning of [Rule 405]; a majority-owned subsidiary of that registrant; or a controlling entity that owns more than 50 percent of the registrant's outstanding voting securities. A note should be added to the “Calculation of Registration Fee” table in the subsequent registration statement(s) providing the following information unless expressly required in another part of the registration statement:

- The dollar amount of the previously paid filing fee to be offset against the currently due filing fee;

- The amount of unsold securities or unsold aggregate offering amount from the prior registration statement associated with the claimed offset;

- The file number and name of the registrant that filed, the earlier registration statement from which the filing fee is offset

- The initial filing date of the earlier registration statement; and

- A statement that the registrant has:

- Withdrawn the prior registration statement; or

- Terminated or completed any offering that included the unsold securities associated with the claimed offset under the prior registration statement.

Below are the steps to claim offsets from terminated offerings for the registration of new securities using Rule 457(p), and offset all of the filing fees:

- Access FEPT on an S-8 submission by following steps 1 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a).

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities.”

- Select a rule from the “Fee Calculation or Carry Forward Rule” drop down list and enter all the applicable fields for a “Fees To Be Paid” Offering line. “Table 1: Newly Registered and Carry Forward Securities” displays the newly added “Fees To Be Paid” offering line.

- Select the + icon to add an offset line under “Table 2: Fee Offset Claims and Sources”.

- Select Rule 457(p) from the “Offset Rule” drop down list.

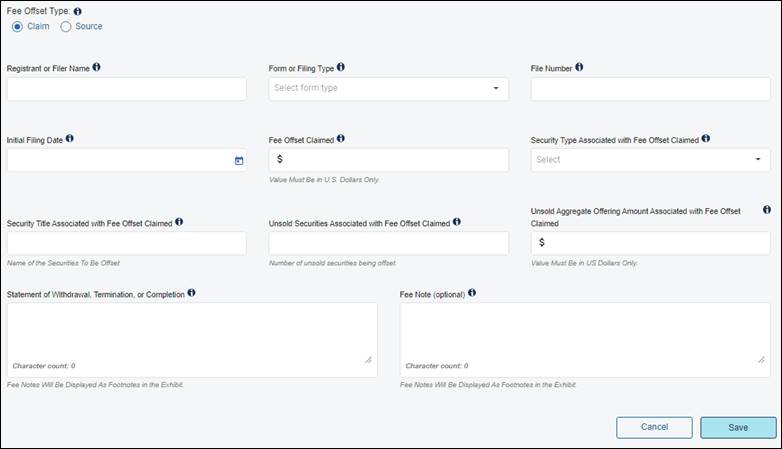

Identify the filing from which you are claiming an offset and keep the details handy. - Select “Claim” as the “Fee Offset Type” and enter the following details:

- Enter the name of the registrant that filed the earlier registration statement from which the offset is claimed in the “Registrant or Filer Name” field.

Note: The name provided must be the same as provided on the current filing unless the registrant is the same but it changed its name or the registrant on the current filing is the earlier registrant’s successor, majority-owned subsidiary, or parent owning more than 50% of the earlier registrant’s outstanding voting securities eligible to claim a filing fee offset. The system will verify if the registrant or filer name matches the name on the original filing. - Select the form or filing type of the earlier registration statement from which the offset is claimed, from the “Form or Filing Type” drop down list.

- Enter the file number of the earlier registration statement from which the offset is being claimed in the “File Number” field. If the offset filing for the 457(p) offset has a Securities Act file number and an Investment Company Act (811-) file number, report the Securities Act file number.

- Using the date picker, select the initial filing date of the earlier registration statement from which the offset is claimed from the “Initial Filing Date” field.

Note: EDGAR will validate the “Initial Filing Date” in a Fee Offset Claim line falls within five years from the initial “Filing Date” of the registration statement for which fees are being calculated, and display the following warning if the validation fails:- “Warning: The Initial Filing Date {offstClaimInitialFilingdate} for the Fee Offset Claims line is invalid, since it does not fall within the five years of the initial Filing Date of the registration statement {regInitialFilingDate} for which fees are being calculated. Please provide an Initial Filing Date that falls within five years of the initial Filing Date of the statement for which fees are being calculated.”

- Enter the dollar amount of the previously paid filing fee to be offset against the currently due fee under Rule 457(p) in the “Fee Offset Claimed” field.

- Select the security type of the unsold securities registered on the earlier registration statement associated with the fee offset claimed.

- Enter the title of the class of unsold securities registered on the earlier registration statement associated with the fee offset claimed.

- Enter the number of unsold securities registered on the earlier registration statement associated with the fee offset claimed in the “Unsold Securities Associated with Fee Offset Claimed” field. This field is required if the earlier registration statement relied on Rule 457(a) and otherwise as applicable.

EDGAR will validate that the amount entered is a numeric value that is less than or equal to number of securities previously registered on the earlier registration statement for the same security title and security type using the file number provided. The system will generate the following warning if you enter a value that exceeds the consolidated/cumulative number of securities registered on the prior registration statement:

Warning: Value for the Unsold Securities Associated with Fee Offset Claimed amount {offstClaimAmtSecuritiesUnsold} is invalid because it exceeds the number of securities previously registered {regAmtSecurities}for the Security Type {secType} and Security Title {secTitle} for the File Number {offstClaimfileNumber}.

- Enter the aggregate offering amount of unsold securities registered on the earlier registration statement associated with the fee offset claimed in the “Unsold Aggregate Offering Amount Associated with Fee Offset Claimed” field.

EDGAR will validate that the aggregated offering amount is a numeric value that is less than or equal to Maximum Aggregate Offering Price previously registered on the earlier registration statement for the same security type and security title using the file number provided. The system will generate the following warning if you enter an Maximum Aggregate Offering Price value that exceeds the consolidated/cumulative number registered on the prior registration statement:- Warning: Value for the Unsold Aggregate Offering Amount Associated with Fee Offset Claim {offstClaimsaggrgteOfframt} for the Fee Offset Claims line is invalid because it exceeds the amount registered previously for the Security Type{secType} and Security Class Title {secTitle} for the File Number {offstClaimfileNumber}.

Note: If the specified number of unsold securities and/or the unsold offering amount relates to a registration that relied on 457(r) or 457(s), the system will not perform this validation. Instead, EDGAR will generate an Informational message stating that these amounts cannot be greater than the amount of securities registered on the prior filing included as the basis for Rule 457(p) fee offset claim.

- Warning: Value for the Unsold Aggregate Offering Amount Associated with Fee Offset Claim {offstClaimsaggrgteOfframt} for the Fee Offset Claims line is invalid because it exceeds the amount registered previously for the Security Type{secType} and Security Class Title {secTitle} for the File Number {offstClaimfileNumber}.

- Provide a statement that the registrant has either withdrawn each prior registration statement or has terminated or completed any offering that included the unsold securities associated with the claimed offset under the prior registration statement(s) in the “Statement of Withdrawal, Termination, or Completion” text box. This is a required field.

- Enter a fee note (optional) to describe the offset being claimed.

- Select “Save” to save the offset claim line.

- Enter the name of the registrant that filed the earlier registration statement from which the offset is claimed in the “Registrant or Filer Name” field.

- Identify the previous submission with contemporaneous fee payments that is the original source to which the fee offset claimed on this filing can be traced. To add an offset source for the fee offset claimed line, follow the steps below:

- Select the + icon to add an offset line under “Table 2: Fee Offset Claims and Sources”

- Select 457(p) from the “Offset Rule” drop down list

Identify the filing that you will include as the offset source and keep the details ready. - Select “Source” as the Fee Offset Type and enter the following details:

- Provide the name of the registrant or filer that filed the earlier submission that is identified as a fee offset source.

Note: The system verifies if the Registrant or Filer Name matches with the name on the original filing. - Select the form or filing type of the earlier submission that is identified as a fee offset source.

- Enter the file number of the earlier submission that is identified as a fee offset source. Allowable prefixes are: 333, 033, 002, 001, 811, 814, 005, and 000

- Using the date picker, select the filing date of the earlier submission that is identified as a fee offset source.

- Enter the dollar amount of the contemporaneous fee payment made with respect to each identified fee offset source. A contemporaneous fee payment is the payment of a required fee that is satisfied through the actual transfer of funds and does not include any amount of required fee satisfied through a claimed fee offset.

- Enter a fee note (optional) to describe the fee offset source.

- Select “Save” to save the offset source line.

Table 2: Fee Offset Claims and Sources displays the newly added offset claim and source line.

- Provide the name of the registrant or filer that filed the earlier submission that is identified as a fee offset source.

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid (zero since it is not applicable)

- Total Fee Offsets

- Net Fee Due

Claiming offsets using Rule 457(b)/0-11(a)(2)

Rule 457(b): If relying on Rule 457(b) or Rule 0-11(a)(2) to offset some or all of the filing fee due on this filing by amounts paid in connection with earlier filings (other than this Form, Schedule or Statement, subject to limited exceptions (see, e.g., Form S-3 Calculation of Filing Fee Tables instruction 2.A.iv regarding a pre-effective amendment filed to concurrently increase and decrease securities of different classes where a registrant did not rely on Rule 457(o))) relating to the same transaction, provide the following information.

- Fee Offset Claims.

For each earlier filed Securities Act registration statement or Exchange Act document relating to the same transaction from which a fee offset is being claimed, provide the information that Table 2 requires. The “Fee Offset Claimed” column requires the dollar amount of the previously paid filing fee to be offset against the currently due fee.

Note: If claiming an offset from a Securities Act registration statement, provide a detailed explanation of the basis for the claimed offset.

- Fee Offset Sources.

With respect to amounts claimed as an offset under Rule 457(b) or Rule 0-11(a)(2), identify the initial submissions with contemporaneous fee payments that are the original source to which those amounts can be traced. For each submission identified, provide the information that Table 2 requires. The “Fee Paid with Fee Offset Source” column requires the dollar amount of the contemporaneous fee payment made with respect to each identified submission that is the source of the fee offset claimed pursuant to Rule 457(b) or Rule 0- 11(a)(2). The aggregate of the amounts reported in the “Fee Paid with Fee Offset Source” column must be equal to or greater than the aggregate of the amounts reported in the “Fee Offset Claimed” column.

Fee offsets presented on a filing should reflect all the offsets being claimed in connection with the transaction, regardless of whether any or all of the offsets were listed previously on the initial filing and/or a prior amendment.

Below are steps to claim an offset using Rule 457(b)/0-11(a)(2):

- Access FEPT on an S-11 submission by following steps 1 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a).

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities.”

- Select a rule from the “Fee Calculation or Carry Forward Rule” drop down list and enter all the applicable fields for a “Fees To Be Paid” offering line.

“Table 1: Newly Registered and Carry Forward Securities” displays the newly added “Fees To Be Paid” offering line. - Follow the steps described in Claiming offset(s) from terminated offerings for the registration of new securities through Rule 457(p) to add an offset claim/source line(s) with the following details:

Data entry for Fee Offset Claim line(s):- Select the form or filing type of the prior filing from which the offset is claimed.

- Provide the file number of the prior filing from which the offset is claimed. If the offset filing for the 457(b) offset has a Securities Act file number and an Investment Company Act (811-) file number, the Securities Act file number should be reported.

- Using the date picker, select the initial filing date of the prior filing from which the offset is claimed.

- Enter the dollar amount of the previously paid filing fee to be offset against the currently due fee under Rule 457(b) or Rule 0-11(a)(2).

- If claiming an offset from a Securities Act registration statement under Rule 457(b) or Rule 0-11(a)(2), provide a detailed explanation of the basis for the claimed offset.

- Enter details relating to the fee calculation as necessary to clarify the information presented in Table 2.

- Click Save.

- Repeat steps “a” through “g” to add another fee offset claim line.

Data entry for Fee Offset Source line(s):

- Provide the name of the registrant or filer that filed the earlier submission that is identified as a fee offset source.

- Select the form or filing type of the earlier submission that is identified as a fee offset source.

- Enter the file number of the earlier submission that is identified as a fee offset source.

- Using the date picker, select the filing date of the earlier submission that is identified as a fee offset source.

- Provide the dollar amount of the contemporaneous fee payment made with respect to each identified fee offset source. A contemporaneous fee payment is the payment of a required fee that is satisfied through the actual transfer of funds, and does not include any amount of required fee satisfied through a claimed fee offset.

- Disclose specific details relating to the fee calculation as necessary to clarify the information presented in Table 2.

- Click Save.

- Repeat steps “a” through “g” to add another fee offset source line.

- Table 2: Fee Offset Claims and Sources displays the newly added offset claim and source line.

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid (will be zero since it is not applicable)

- Total Fee Offsets

- Net Fee Due

Including a Combined Prospectus

Including a combined prospectus...

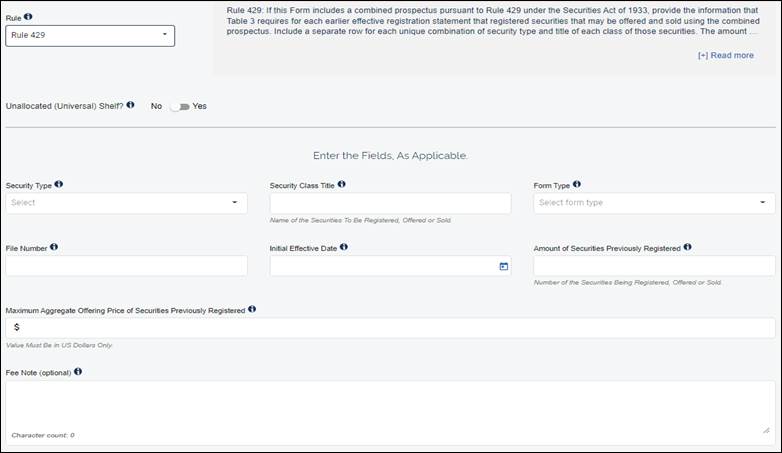

Rule 429: If the Form includes a combined prospectus pursuant to Rule 429 under the Securities Act of 1933, provide the information that Table 3 requires for each earlier effective registration statement that registered securities that may be offered and sold using the combined prospectus. Include a separate row for each unique combination of security type and title of each class of those securities. The amount of securities previously registered that may be offered and sold using the combined prospectus must be expressed in terms of the number of securities (under column heading “Amount of Securities Previously Registered”), or, if the related filing fee was calculated in reliance on Rule 457(o), must be expressed in terms of the maximum aggregate offering price (under column heading “Maximum Aggregate Offering Price of Securities Previously Registered”).

Below are steps to register new securities and include the combined prospectus in reliance of Rule 429 using FEPT:

- Access FEPT on an F-3 submission by following steps 1 to 8 documented in Submit an initial registration statement with offerings in reliance on Rule 457(a).

- Select the + icon to add an offering line under “Table 1: Newly Registered and Carry Forward Securities.”

- Select a rule from the “Fee Calculation or Carry Forward Rule” drop down list and enter all the applicable fields for a “Fees To Be Paid” Offering line.

“Table 1: Newly Registered and Carry Forward Securities” displays the newly added “Fees To Be Paid” offering line. - Select the + icon to add a combined prospectus line under “Table 3: Combined Prospectuses.”

- Select “Rule 429” from the “Rule” drop down list.

- Select the type of securities previously registered that may be offered and sold using the combined prospectus from the “Security Type” drop down list.

Note: Move the slider to the “Yes” position if you are referencing a registration with Security Type “Unallocated (Universal) Shelf.” - Enter the title of the class of securities previously registered that may be offered and sold using the combined prospectus in the “Security Class Title” field.

Note: Using combined prospectuses under Rule 429 is different than carrying forward securities under Rule 415(a)(6). When combined prospectuses are used under Rule 429, the securities registered on the prior filing remain registered on the prior filing – they do not become part of the total amount of securities registered on the new filing. In contrast, when a filer “carries forward” securities under Rule 415(a)(6), the securities are moved from the old filing to the new, so they do not remain registered on the prior filing.

- Select the form type from the “Form Type” drop down list of the earlier effective registration statement that registered securities that may be offered and sold using the combined prospectus.

- Enter the file number of the earlier effective registration statement(s) on which securities were previously registered that may be offered and sold using the combined prospectus. If a prior registration statement has a Securities Act file number and an Investment Company Act (811-) file number, the Securities Act file number should be reported.

- Using the date picker, select the initial effective date of the earlier registration statement on which securities were previously registered.

- Enter the amount of securities previously registered that may be offered and sold using the combined prospectus unless the related filing fee was calculated in reliance on Rule 457(o). EDGAR will validate that the amount specified does not exceed the amount registered on the prior filing using the file number provided. The system will generate the following warning if you enter an “Amount Registered” value that exceeds the consolidated/cumulative number registered on the prior registration statement:

- Warning: Value for Rule 429 Amount of Securities Previously Registered is invalid because the amount {429AmtSecuritiesRegistered} exceeds the number of securities previously registered {regAmtSecurities}, for the Security Type {secType} and Security title {secTitle} for the File Number {429fileNumber}.

- Enter the maximum aggregate offering price of securities previously registered that may be offered and sold using the combined prospectus if the related filing fee was calculated in reliance on Rule 457(o). EDGAR will validate that the numeric value is less than or equal to Maximum Aggregate Offering Price previously registered on the prior filing for the same security type and security title using the file number provided. The system will generate the following warning if you enter an “Maximum Aggregate Offering Price” value that exceeds the consolidated/cumulative number registered on the prior registration statement:

- Warning: Value for Rule 429 Maximum Aggregate Offering Price (MAOP) of Securities Previously Registered amount ${429MAOP} is invalid because it exceeds the MAOP registered previously on the prior registration statement ${MAOPReg} for the Security Type {secType}, Security Title {secTitle}, and File Number {429FileNumber} for the Combined Prospectus line.

Note: If the “Amount of Securities Previously Registered” or the “Maximum Aggregate Offering Price” value specified in Table 3 relates to a registration that relied on 457(r) or 457(s), the system will not perform this validation. Instead, the system will generate an Informational message stating that Table 3 may not include a greater Amount of Securities/Maximum Aggregate Offering Price than remains registered under the prior filing.

- Warning: Value for Rule 429 Maximum Aggregate Offering Price (MAOP) of Securities Previously Registered amount ${429MAOP} is invalid because it exceeds the MAOP registered previously on the prior registration statement ${MAOPReg} for the Security Type {secType}, Security Title {secTitle}, and File Number {429FileNumber} for the Combined Prospectus line.

- Enter a fee note to disclose specific details as necessary to clarify the information presented in Table 3.

- Select the [Save] button. Table 3: Combined Prospectuses displays the newly added combined prospectus line.

- The “Fee Totals” summary values are displayed on the left navigation pane of the FEPT interface as follows:

- Total Registration Fees

- Total Fees Previously Paid (will be zero since it is not applicable)

- Total Fee Offsets (will be zero since no offsets are being claimed)

- Net Fee Due

Registering additional securities in the registration statement filed under Rule 462(b) (*MEF)

Registering additional ...

Filers can register additional securities of the same security types/classes in the *MEF filing as were included in the earlier registration statement.

FEPT will generate the following warning if the security type/security class specified in the *MEF filing was not included in the earlier registration statement.

- Warning: Registrants may only register additional securities of the same type/ class(es) as were included in the earlier registration statement. Please correct the Security Type <secType> and <secTitle> and resubmit the filing. If not corrected, the submission may require subsequent amendment.

Filers cannot register more than 20% of the Maximum Aggregate Offering Price for each class of securities when compared to the original registration.

FEPT will generate the following warning on the *MEF filing if the Maximum Aggregate Offering Price is more than 20% of the Maximum Aggregate Offering Price for each security type/class in the original registration.

- Warning: The Maximum Aggregate Offering Price MAOP <MAOP> for Security Type <secType> and Security Class Title <secTitle> exceeds the 20% limit of the Maximum Aggregate Offering Price of that class included on the earlier registration statement. Please correct the Maximum Aggregate Offering Price specified for Security Type <secType> and Security Class Title <secTitle>, and resubmit the filing. See Securities Act Rule 462(b).

EDGAR will also generate warnings for filer-constructed submissions if a security type/security class in the *MEF filing was not included in the earlier registration statement, or if filers register more than 20% of the Maximum Aggregate Offering Price for each security type/class when compared to the original registration.

Note(s):

- See Chapter 3 (Index to Forms) of the EDGAR Filer Manual, Volume II: "EDGAR Filing" for a list of *MEF forms.

- EDGAR will perform the 20% validation and security type/security class validation, only if the original registration is effective.

- For submission type N-14MEF, the system shall use the N-14 8C file number provided by the filer to perform the 20% maximum aggregate offering price check.

Submitting...

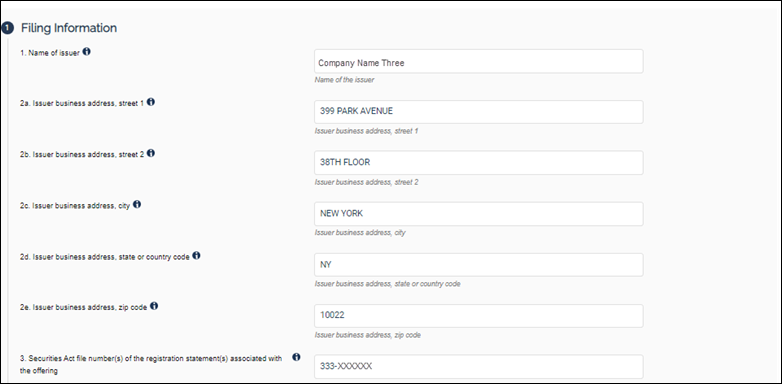

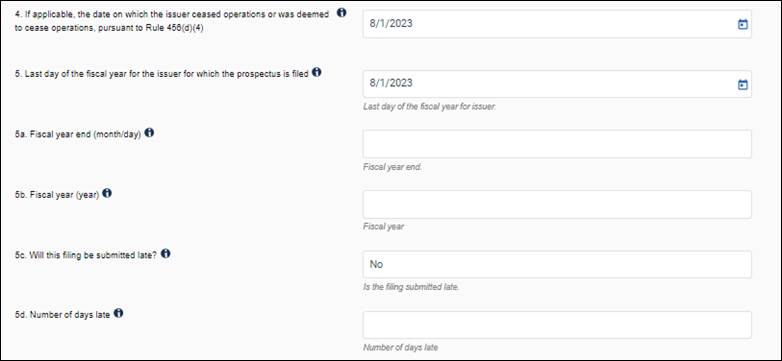

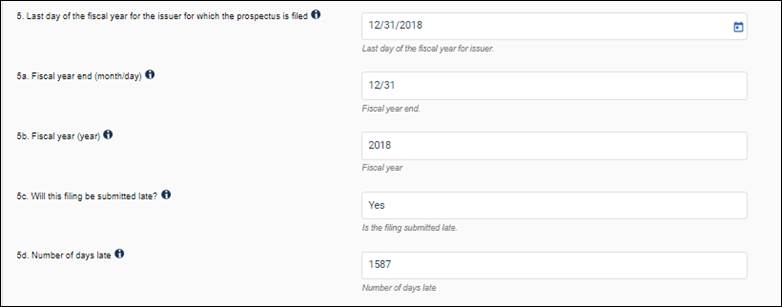

Submitting Form F-10 (and its variants) and calculating fees as specified in General Instruction II.H/II.I