Electronic Filing of Form X-17A-5 Part III (Broker-Dealer, Security-Based Swap Dealer, and Major Security-Based Swap Participant Annual Reports)

- In order to make electronic filings using EDGAR, a filer must have EDGAR access credentials. Instructions for obtaining these credentials for broker-dealers are located here: Procedures for Broker-Dealers to Obtain EDGAR Access Credentials for Submission of Form X-17A-5 Part III Annual Reports and Amendments. Security-based swap dealers and major security-based swap participants will use the EDGAR access credentials that they obtained when registering with the Commission as a security-based swap entity.

- Once a filer has access credentials, it accesses EDGAR through the following link: https://www.edgarfiling.sec.gov/Welcome/EDGARLogin.htm. The filer would enter its CIK and password on this page:

Note: if the CIK is unknown, an EDGAR Search function can be used to find it: http://www.sec.gov/edgar/searchedgar/companysearch.html or https://www.edgarcompany.sec.gov/. If a filer has multiple CIKs, it must use the CIK associated with its FOCUS Reports on EDGAR. (For a broker-dealer, the File Number associated with its Form X-17A-5 Part III will begin with 008. For a security-based swap entity, the File Number associated with its Form X-17A-5 Part III will begin with 026.)

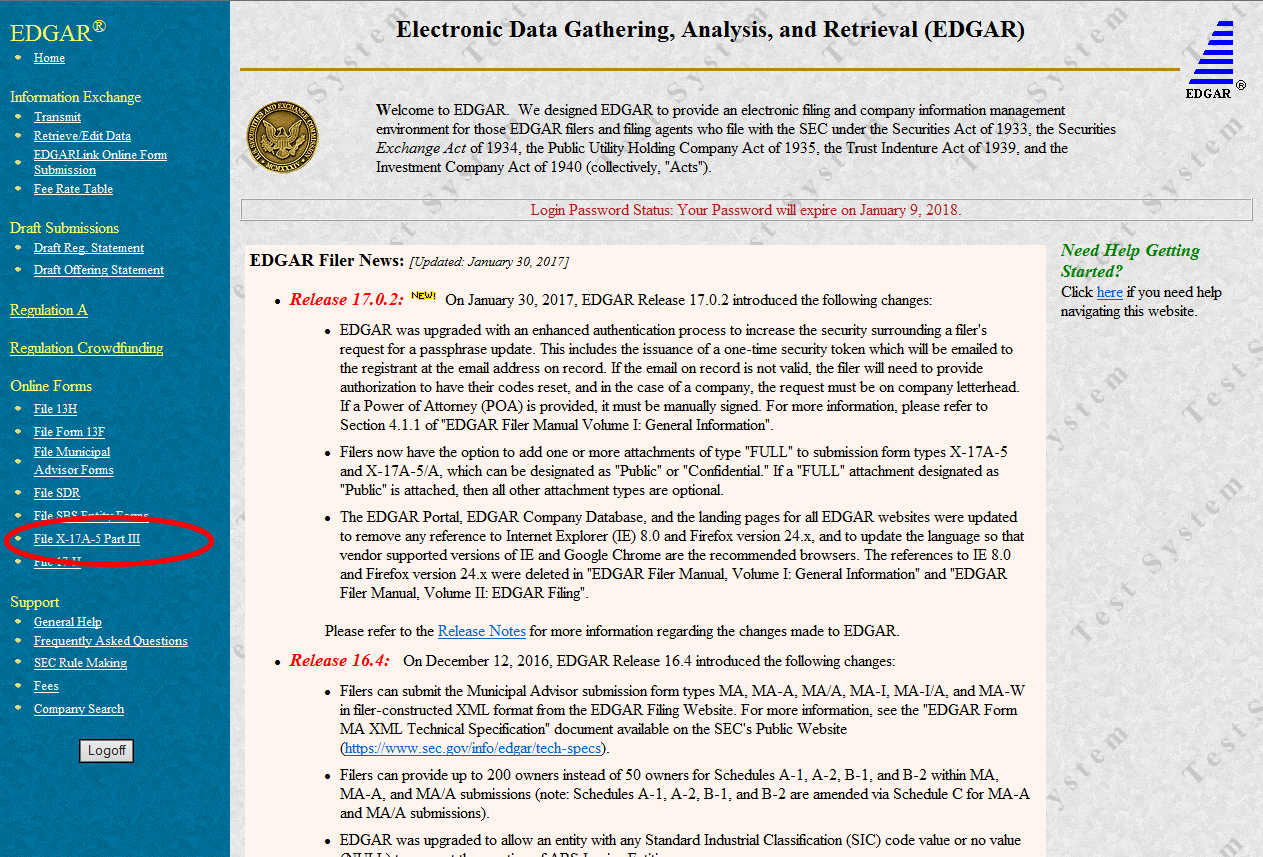

- 3. On the next page, the filer would choose the “File X-17A-5 Part III” option on the left sidebar:

- On the next page, for a new filing the filer would choose “Annual Reports (X-17A-5).” If the filer is filing an amendment, it would choose “Amendment to Annual Reports (X-17A-5)/A).” (Note: See instruction 6.c. below regarding the filing of an amendment.) On the following four pages, the filer would enter filer information and submission information, which includes identification of the filer and the accountant.

Note: With regard to the question, “Is this an electronic copy of an official filing that was submitted in paper format on the “Filer Information” screen: If the filer submitted the annual reports for the same period in paper and the receipt of the reports was entered into EDGAR by SEC staff, the box must be checked in order for EDGAR to permit the electronic filing, which would be a confirming copy of the official submission already made in paper. In this situation, if the box is not checked, EDGAR will view the electronic filing for the same period as a duplicate and will not allow it.

Note: Certain fields on these pages will be prepopulated. Broker-dealers must submit a Form BD/A (Amendment) to CRD to update their company information. The Form BD/A filing will automatically update the company information in EDGAR. All other filers must submit a COUPDAT (Company Update) through EDGAR. In either case, thereafter the new company information will be prepopulated into the applicable fields on future Form X-17A-5 submissions.

- The fifth page is a signature page, which contains the oath or affirmation from Form X-17A-5 Part III. On this page, the filer must enter the name and title of the person making the oath or affirmation. The page also contains a box, which, except as noted below, the filer must check to acknowledge that the oath or affirmation was notarized. The filer must make a paper copy of the oath or affirmation from Form X-17A-5 Part III, and must retain the original paper copy of the notarized oath or affirmation in its records. Form X-17A-5 Part III can be found at http://www.sec.gov/about/forms/formx-17a-5_3.pdf. The paper copy must be retained for a period of not less than six years, the first two years in an easily accessible place. However, note that the staff of the Division of Trading and Markets stated that certain filers that find it impracticable to obtain notarization services as a result of COVID-19 can file their Form X-17A-5 Part III without a notarization under certain conditions. See https://www.sec.gov/tm/paper-submission-requirements-covid-19-updates-061820.

- On the sixth page, a filer would upload the annual reports. The documents may be uploaded in HyperText Markup Language (“HTML”), American Standard Code for Information Interchange (“ASCII”), or Portable Document Format (“PDF”).

- For stand-alone OTC Derivatives Dealers filing audited financial statements under Rule 17a-12, the statements (including accountant’s reports under paragraphs (k), (l), and (m) of Rule 17a-12) may be uploaded as one confidential document. For broker-dealers filing annual reports under Rule 17a-5 and for security-based swap dealers and major security-based swap participants filing annual reports under Rule 18a-7, the annual reports may be uploaded as one public document or, alternatively, as one public document and one confidential document as follows:

- Upload a Single Document. The broker-dealer, security-based swap dealer, or major security-based swap participant can elect to upload all of the annual reports as a single public document. In this case, the filer would click the “Add Document” button and upload the single document. The filer would then choose “FULL” as the document “Type” from the drop-down menu. The filer may add a description if desired. The “Request Confidentiality” button must not be checked, as certain of the items in the annual reports must be made public. The filer would then click the “Submit” button at the top of the page:

- Upload Two Documents. The filer can elect to file one document that will made public and another document that will be kept confidential. In this case, the filer would attach two documents to its submission (a public document and a confidential document):

- Public Document. The public document must contain, at a minimum, the statement of financial condition, the notes to the statement of financial condition, and an accountant’s report which covers the statement of financial condition (the notes and the accountant’s report may cover the entire financial report). To do this, the filer would click the “Add Document” button and upload the public document. The filer would then choose “FULL” as the document “Type” from the drop-down menu. The filer may add a description if desired. The “Request Confidentiality” button must not be checked, as these items must be made public. The filer should not click the “Submit” button until it has uploaded the confidential document discussed next.

- Confidential Document. The confidential document must contain all of the items of the annual reports that the filer must file. In other words, the confidential document must contain the items of the annual reports included in the public document (at a minimum, the statement of financial condition, the notes to the statement of financial condition, and an accountant’s report which covers the statement of financial condition) and the remaining required items in the annual reports. To do this, the filer would click the “Add Document” button and upload the confidential document. The filer would again choose “FULL” as the document “Type” from the drop-down menu. The filer may add a description if desired. The filer must check the box labeled “Request Confidentiality.” Once both documents have been uploaded, the filer can click the “Submit” button at the top of the page:

- As indicated above, except for stand-alone OTC Derivatives Dealers filing audited financial statements under Rule 17a-12, the filer must submit one document for which the “Request Confidentiality” button is not checked (that is, one document must be made public). Consequently, if a filer (other than an OTC Derivatives Dealers filing audited financial statements under Rule 17a-12) clicks the “Submit” button before attaching a document for which the “Request Confidentiality” button is not checked, the filer will receive an error message. Note: Filers filing an amendment to Form X-17A-5 must file the entire annual reports—not simply those items that are being amended. Consequently, the above applies with regard to the required filing of a document for which the “Request Confidentiality” button is not checked.

To correct the error and successfully file the annual reports, the broker-dealer can take the steps described in Instruction 7.(a) (that is, file the annual reports in one “Full” document that is made public) or Instruction 7.(b) (that is, file the annual reports in two “Full” documents – one that is made public and one that is kept confidential).

- Upload a Single Document. The broker-dealer, security-based swap dealer, or major security-based swap participant can elect to upload all of the annual reports as a single public document. In this case, the filer would click the “Add Document” button and upload the single document. The filer would then choose “FULL” as the document “Type” from the drop-down menu. The filer may add a description if desired. The “Request Confidentiality” button must not be checked, as certain of the items in the annual reports must be made public. The filer would then click the “Submit” button at the top of the page:

- Any document for which the filer does not request confidentiality will be made public on EDGAR immediately after the filer has filed the reports on EDGAR.

- Items that are not required to be made public and for which confidential treatment is requested by a filer will be kept confidential, subject to the provisions of applicable law.

- Reports submitted electronically will be considered filed with the Commission when the EDGAR system accepts a complete and properly executed filing, at which point the EDGAR system will send the filer an automated email notifying the filer that the submission has been accepted by the Commission. The email will contain the name of the filer; the “Form Type” that was submitted (“X-17A-5”); the dates received, accepted, and filed; the “accession number” of the filing (which is to be used for future inquiries regarding the filing); the file number; and any warnings associated with the filing (for example, that the filing was not timely received).

- A filer that files the annual reports electronically with the Commission in accordance with the above instructions does not need to file the annual reports in paper form, and does not need to file the annual reports with the regional office of the Commission in the region in which the filer has its principal place of business. In all other respects, the filer’s annual and supplemental reports must comply with the requirements of Rule 17a-5, Rule 17a-12, or Rule 18a-7, as applicable.

- Filers can contact the Commission’s electronic filer support at (202) 551-8900, option 3 (technicians are available live from 9:00 am-5:30 pm EST Monday-Friday except federal holidays) or at filertechunit@sec.gov for procedural and technical questions.

- Substantive questions regarding the filing requirements should be directed to the Commission’s Division of Trading and Markets by calling (202) 551-5777 or by e-mailing tradingandmarkets@sec.gov.

Click on the image to open a full-size version in a new window.

Click on the image to open a full-size version in a new window.